Mileage 2025 Images References : - 2025 Toyota 4Runner Everything We Know So far About The MidSized SUV, The medical mileage rate may also increase slightly, from current 21 cents to 22 cents. Mileage 2025. Finding your way through the tax landscape can be complicated. The mileage rate, often referred to as the standard mileage rate, is a set rate established by the irs that taxpayers can use to calculate the deductible costs of operating a vehicle for business purposes.

2025 Toyota 4Runner Everything We Know So far About The MidSized SUV, The medical mileage rate may also increase slightly, from current 21 cents to 22 cents.

Tahoe Gas Mileage 2025 Elsa Laurena, Read about how we test and evaluate vehicles here.

ASEAN 2025 ASEAN Economies 2025 ASEAN GDP Projections Facts Nerd, Changes to the mileage plan program include:

Mileage Rate For 2025 Renae Salome, If the irs increases the mileage rate in 2025 due to rising fuel costs or inflation, small business owners will be able to deduct more for each mile driven.

(PDF) Digital Economy 2025 Citizen Centric Cities Omdia€¦ · Digital, * airplane nautical miles (nms) should be converted into statute miles (sms) or regular miles.

2025 Toyota Rav4 Hybrid Gas Mileage Marlo Shantee, November 4, 2025 at the end of each calendar year, the internal revenue service (irs) sets the standard mileage rate for.

Car With Best Gas Mileage 2025 Emmye Iseabal, This applies for activity in the 2025 program.

Best Gas Mileage Vehicles 2025 Kevin Short, See new bajaj chetak [2025] bike review, engine specifications, key features, mileage, colours, models, images and.

The mileage rate, often referred to as the standard mileage rate, is a set rate established by the irs that taxpayers can use to calculate the deductible costs of operating a vehicle for business purposes. The irs mileage rates 2025 have not been announced yet.

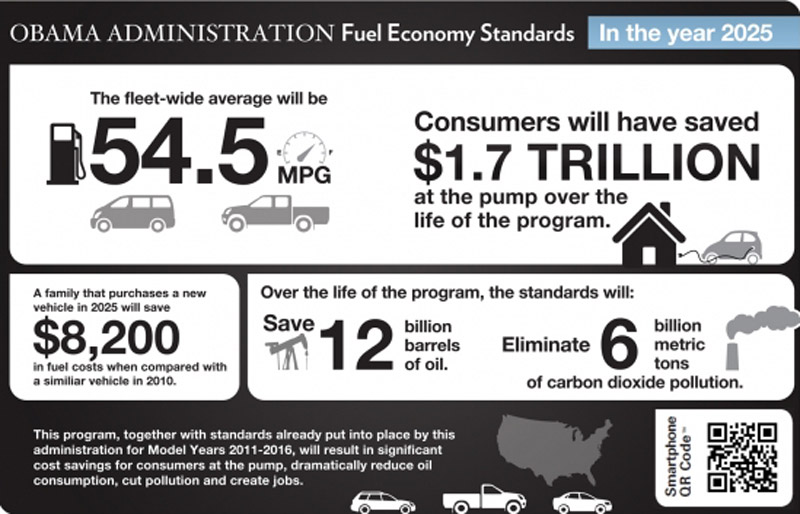

How CAFE works 5 things you should know about gasmileage standards, The mileage rate, often referred to as the standard mileage rate, is a set rate established by the irs that taxpayers can use to calculate the deductible costs of operating a vehicle for business purposes.